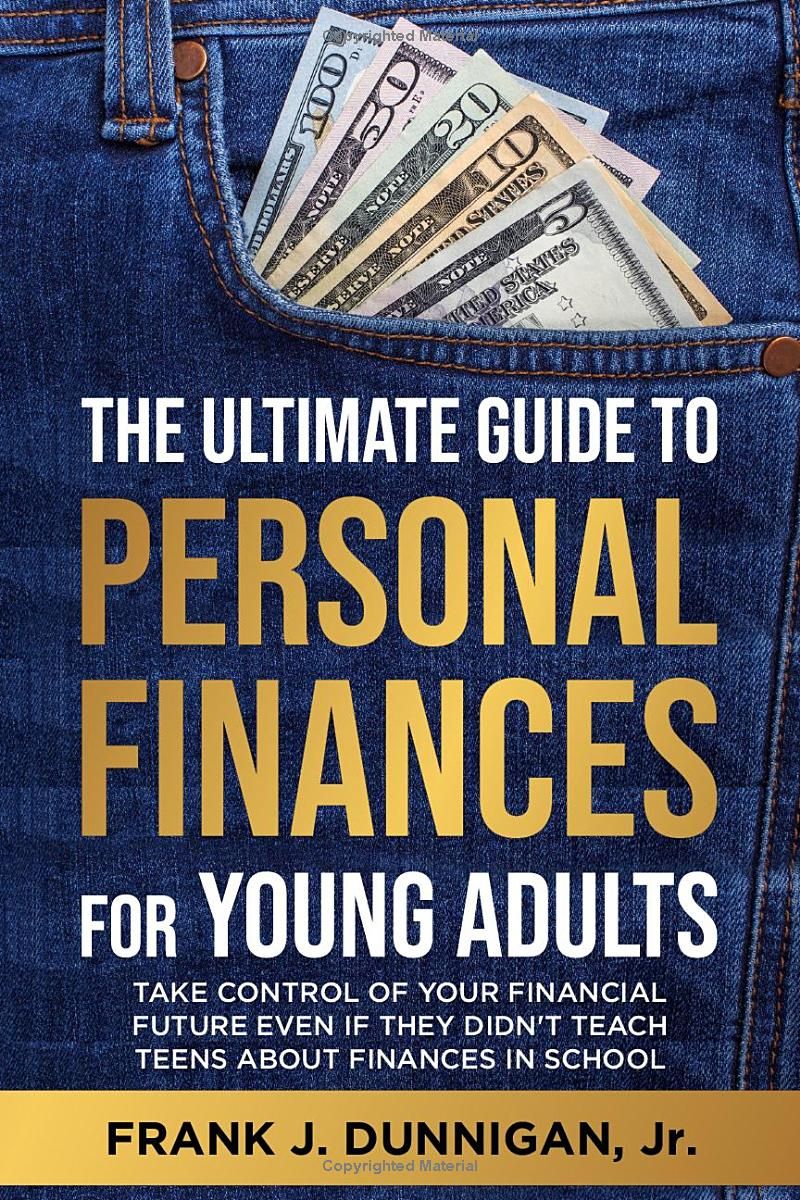

Feeling lost in the world of personal finance? "The Ultimate Guide to Personal Finances for Young Adults" by Frank J. Dunnigan Jr. is your roadmap to financial freedom. This book cuts through the jargon, offering clear, actionable advice specifically tailored for young adults and teens. Learn how to create a budget, improve your credit score, manage student loans, and even start investing—all with easy-to-follow steps and real-life examples. From understanding compounding interest to navigating taxes and choosing the right insurance, this guide equips you with the knowledge and strategies to build a secure financial future, regardless of what you learned (or didn't learn) in school. Take control of your money today—start building your wealth tomorrow.

Review The Ultimate Guide To Personal Finances For Young Adults

I thoroughly enjoyed "The Ultimate Guide To Personal Finances For Young Adults"! Frank J. Dunnigan Jr. has a real knack for making potentially dry financial information engaging and relatable. He doesn't lecture; instead, he feels like a friendly mentor offering practical advice tailored specifically for young adults navigating the often-confusing world of personal finance.

What struck me most was the author's conversational tone. He uses real-life examples and anecdotes, making the concepts immediately understandable and less intimidating. He doesn't shy away from the challenges young adults face – student loans, social pressures influencing spending habits, and the general uncertainty of starting out in the workforce – but he approaches them with empathy and offers actionable solutions. It's clear he understands his target audience and speaks directly to their concerns.

The book covers a comprehensive range of topics, from budgeting and saving to investing and managing debt, all explained in clear, simple language. There's no overwhelming financial jargon; instead, Dunnigan breaks down complex concepts into digestible steps, making them accessible even for those with little to no prior knowledge of personal finance. I especially appreciated the sections on creating a budget without sacrificing your lifestyle and the practical strategies for avoiding common investment mistakes. These are areas where many young adults struggle, and the book provides realistic and helpful guidance.

The inclusion of digital tools and resources is a smart addition. The book acknowledges the role technology plays in modern finances and suggests helpful apps to track spending and savings goals. This practical approach reflects the realities of how young adults manage their money today. Similarly, the discussion of side hustles and earning extra income is both timely and relevant, offering concrete ideas for supplementing income and building financial stability.

Beyond the specific financial advice, the book conveys a powerful message about the importance of long-term financial planning. Dunnigan emphasizes the benefits of starting early, highlighting the power of compounding interest and encouraging readers to think about their financial future from a young age. This proactive approach is invaluable and sets the book apart from many other financial guides.

While targeted toward young adults, I believe this book offers valuable insights for anyone looking to improve their financial literacy. The principles discussed are timeless and applicable across age groups. Whether you're a teenager just starting to manage your allowance, a young professional paying off student loans, or someone looking to refine their financial strategies, this book provides a wealth of knowledge presented in a highly approachable and effective manner. It's a fantastic resource for building a strong foundation for financial success and confidently navigating the future. I wholeheartedly recommend it.

Information

- Dimensions: 6 x 0.32 x 9 inches

- Language: English

- Print length: 138

- Publication date: 2024

Book table of contents

- Introduction

- BUILDING A SOLID FINANCIAL FOUNDATION

- Mastering Budget Basics: Your First Budget

- Understanding Your Cash Flow: Tracking Income and Expenses

- The Essentials of an Emergency Fund: How Much and Where to Keep

- Smart Banking for Beginners: Choosing the Right Accounts

- Overcoming the Fear of Budgeting: Practical Tips for Consistency

- Financial Goal Setting: Short-Term and Long-Term Planning

- CREDIT AND DEBT MANAGEMENT

- Credit Scores Uncovered: How They Work and Why They Matter

- Managing Credit Card Debt: Avoiding Common Pitfalls

- Navigating Auto Loans: What Young Adults Need to Know

- The Impact of Debt on Your Financial Health

- Using Credit Responsibly: Tips for Young Adults

- INVESTING FUNDAMENTALS

Preview Book